The Buyer Nobody Is Watching

The first trading days of 2026 are revealing something unusual.

Markets are calm. Volatility is muted. Equity indices remain near historic highs.

And yet, beneath the surface, capital is behaving very differently than headlines suggest.

This isn’t a retail story. It isn’t about momentum or sentiment. It’s about scale — and who is quietly absorbing it.

While investors debate rate cuts and AI earnings, one private buyer is taking delivery of massive amounts of physical gold.

Not a central bank.

Not a sovereign wealth fund.

Not a hedge fund headline.

Just one buyer — large enough to move the global market.

Why Gold Is Acting Differently in 2026

Gold did not stumble into the new year by accident.

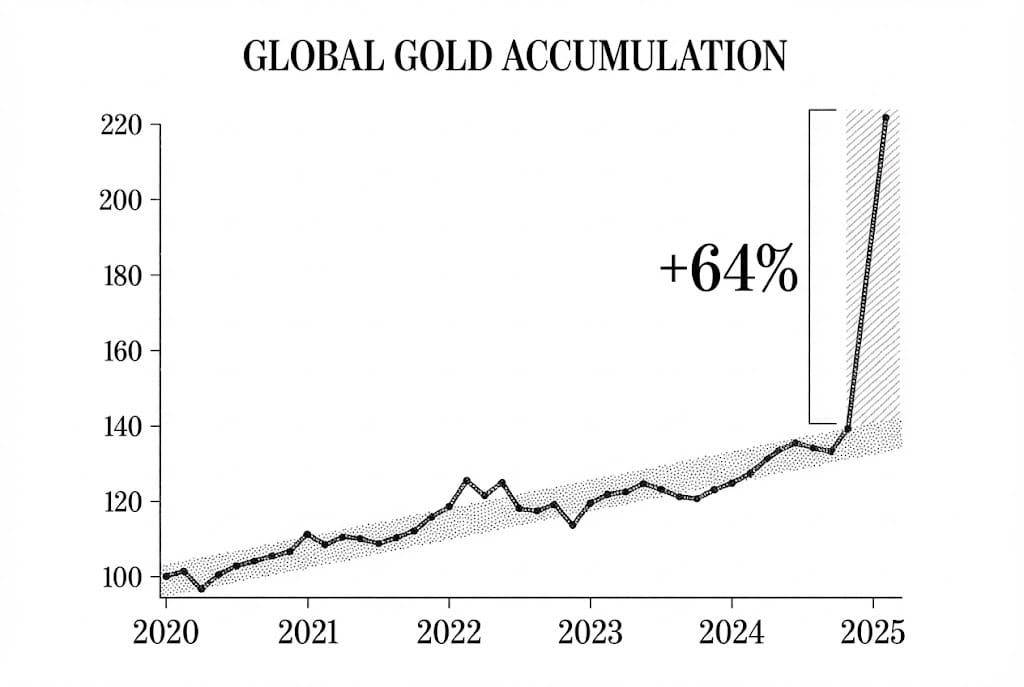

After posting its strongest annual rally since 1979—gaining approximately 64% year-on-year—the metal entered 2026 trading near record levels ($4,370–$4,550 range).

Importantly, it has not seen the kind of mass profit-taking typical after a blow-off rally. That tells us something.

This move isn’t being driven by fear. It’s being driven by reallocation.

According to bank outlooks and data, three forces are now aligned:

1. Structural Buying is Accelerating Central banks and large buyers continue accumulating gold to diversify reserves. Goldman Sachs projects central banks could buy up to ~70 tonnes per month throughout 2026. This is not speculative demand. It’s structural.

2. Smart Money is Not Selling While equities see mixed flows, precious metals funds have just recorded their 8th consecutive week of inflows. The "smart money" is positioning for duration.

3. Real Returns are Compressing Even as nominal yields remain elevated, gold becomes attractive as the real cost of holding it drops.

Why This Isn’t a “Bubble” Story

It’s tempting to frame gold’s move as a mirror image of equity excess. That would be wrong.

Equities are pricing in growth. Gold is pricing in duration.

The most important data point isn’t price — it’s behavior. Despite record highs:

Gold ETFs continue to see inflows.

Physical delivery volumes remain elevated.

Large buyers are showing no urgency to slow down.

That combination rarely appears at the end of a move.

The Bigger Signal Most Investors Miss

When capital begins moving in weekly, industrial-scale quantities, it’s no longer about upside.

It’s about positioning before a system change.

Historically, these phases precede monetary realignments and long periods where paper assets underperform real stores of value.

That doesn’t require a crisis. It only requires time.

Final Thought

Gold is not rising because investors expect chaos. It is rising because confidence in the future is being quietly repriced.

When a single private buyer can absorb billions in physical metal without hesitation, it tells you something important:

The biggest moves don’t announce themselves. They accumulate.

And by the time they show up in headlines, the positioning is already done.

Look who’s buying TWO TONNES of gold per week…

from Golden Portfolio

How did you find today’s briefing?

Written by Deniss Slinkins

Global Financial Journal