Entering 2026: A Market With Fewer Free Lunches

January 1st is one of the rare moments when markets pause, but assumptions reset.

As 2026 begins, Wall Street is confronting an uncomfortable reality: the easy part of this cycle is behind us. Valuations remain elevated. Volatility is low. And across nearly every major 2026 outlook, the same conclusion keeps surfacing — returns will be harder earned.

This is not a crash call. It’s a recalibration.

After two years driven by AI enthusiasm and multiple expansion, markets are entering a phase where timing, structure, and discipline matter more than narratives.

What the Consensus Actually Says About 2026

Across recent outlooks from Reuters, Barron’s, BlackRock Investment Institute, and major U.S. banks, several themes repeat:

1. Equity returns are likely positive — but narrower.

The base case for U.S. equities in 2026 is modest upside, not a repeat of the broad rallies seen earlier in the decade. Leadership is expected to concentrate in companies with real earnings leverage, not just exposure to popular themes.

2. Rate cuts help — but they don’t erase valuation math.

Markets are pricing in gradual easing from the Federal Reserve. That supports assets, but it doesn’t automatically justify stretched multiples. The era of “buy anything, anytime” is over.

3. Volatility is likely to return — quietly.

Not through panic, but through faster rotations, sharper pullbacks, and shorter windows of opportunity.

This is the environment where process beats prediction.

Sector Outlook: Where Capital Is (and Isn’t) Flowing

Technology & AI

Spending remains strong, but investors are becoming selective. Hardware, infrastructure, and firms with visible cash flows are favored over pure story-driven names. The market is differentiating between AI exposure and AI profitability.

Real Estate & Income Assets

Lower rates improve the math for REITs and income strategies, particularly in healthcare and infrastructure-linked real estate. These are being treated as portfolio stabilizers, not growth engines.

International Markets

Relative valuations outside the U.S. remain more attractive. Several strategists expect global diversification to matter again after years of U.S. dominance.

Fixed Income & Cash

After being ignored, yield is back. High-quality bonds and cash-like instruments are once again part of serious portfolio construction — not just parking places.

Why Structure Matters More Than Forecasts

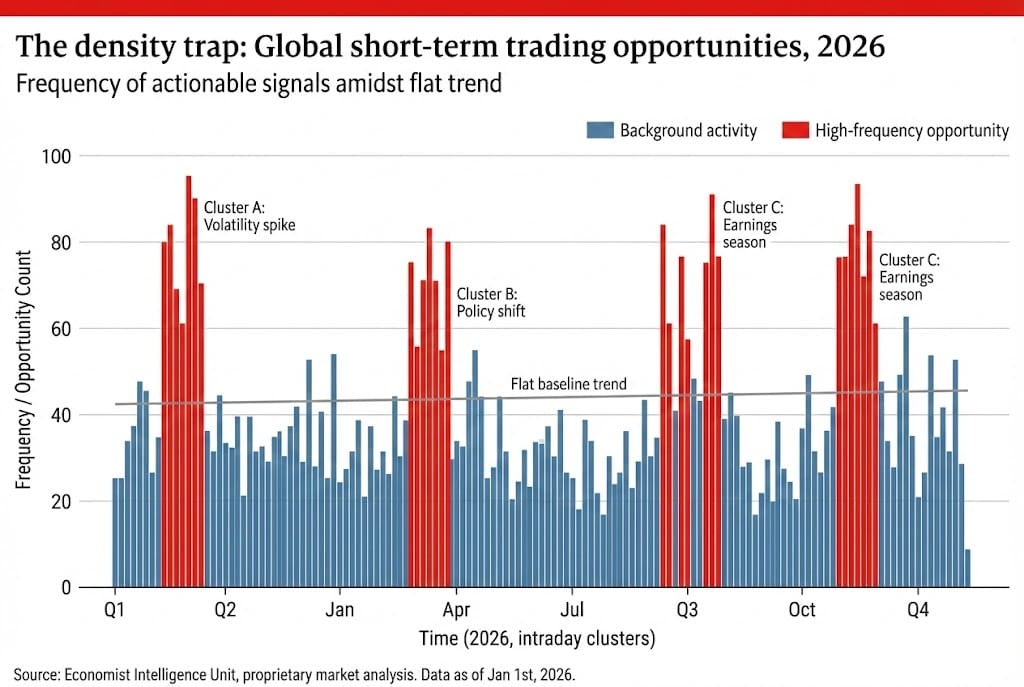

One clear message from 2026 outlooks: directional certainty is lower, but opportunity density remains high.

Markets are expected to move — just not in clean, multi-month trends.

That’s why more investors are shifting attention toward:

Defined trading windows

Repeatable setups

Strategies that don’t depend on being “right” about the year as a whole

In other words, approaches that focus on execution, not macro heroics.

The Bigger Shift Underway

The most important change heading into 2026 isn’t a sector call. It’s behavioral.

After years of passive optimism, markets are transitioning into a phase where:

Timing matters again

Risk management matters again

And patience is no longer the same thing as inaction

This is exactly the kind of environment where well-defined, rules-based strategies regain relevance — not because markets are broken, but because they’re no longer forgiving.

Final Thought

2026 is unlikely to reward complacency. But it doesn’t require fear, either.

It rewards preparation.

Not by guessing where the economy goes — but by having a plan that works inside the market’s most reliable windows, regardless of headlines.

That’s the difference between hoping the cycle cooperates… and being ready when it doesn’t.

Jan 1: The new rules

from Base Camp Trading

How did you find today’s briefing?

Written by Deniss Slinkins

Global Financial Journal