December hasn’t just reduced liquidity — it has changed where the market actually moves.

When depth thins out across global order books, the early part of the session takes on outsized weight. A routine order hits harder. A mispriced auction runs further. And the first hour becomes the moment when most of the day’s real information is revealed.

The Weeks When Market Depth Breaks Down

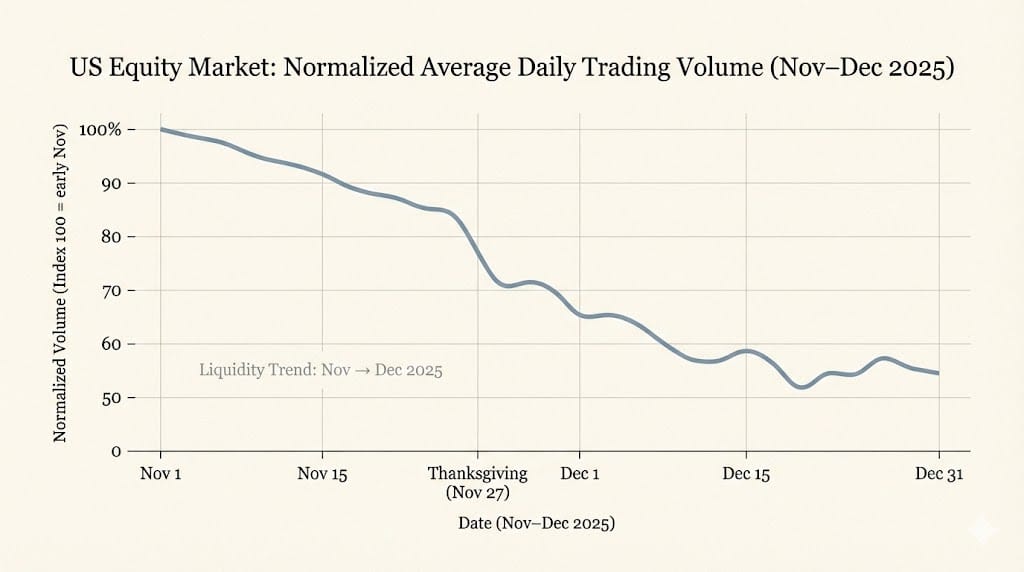

Trading volumes across equities, FX, and fixed income have been sliding for weeks.

Spreads are wider. Execution is slower. And the cost of getting size done keeps rising — the mechanics of the holiday season, but sharper than usual.

Historical data shows the same shape every year: from late November to early January, volumes thin out across nearly every major market. U.S. equity turnover sits around 80% of average before Thanksgiving and can fall below 50% on half-days. FX activity fades 30–50%. European and Asian sessions drift even lower.

Thin markets magnify everything: a routine order moves the tape more than it should, and patience quickly becomes part of the cost.

Large funds have already cut execution windows, pushing most meaningful rebalancing either into early December or the first weeks of January. That leaves the middle stretch of the month unusually sensitive to smaller flows.

Why This December Doesn’t Follow the Script

The seasonal fade is meeting an unusual backdrop.

Rate expectations have swung hard. Market-implied odds for a December Fed cut jumped from near 30% in mid-November to over 80% by month-end. A recent government shutdown delayed key data releases, leaving investors navigating the final stretch of the year with gaps instead of clarity.

And then there’s the AI trade.

Valuations remain stretched — some of the most extended readings since the dot-com era, according to recent stability reports. November’s selloff, triggered by doubts about profitability and shifting rate expectations, produced the sharpest intraday reversals since spring.

Add in thinner liquidity, more passive flows, and leverage-sensitive positioning — and price action becomes jumpier than the headline indices suggest. The VIX has held in the high teens, but short-dated protection is firmer, signalling unease rather than panic.

Where Structure Outperforms Emotion

This is not a market that rewards force. It rewards structure.

Execution risk rises as spreads widen and order books thin.

False breakouts appear more often. Slippage grows.

Timing matters more than usual — not just what you trade, but when you trade it. Yet opportunity hasn’t disappeared. It has shifted.

Recent weeks show defensive sectors quietly outperforming high-beta names. Utilities, healthcare, and staples have regained leadership after months in the background. Gold continues to draw steady inflows — supported by central-bank buying and risk aversion — while Treasuries have benefited from safe-haven bids as equities wobble.

And dividend-payers, often overlooked in fast markets, offer stability when sentiment turns fragile.

This isn’t a call for retreat. It’s a reminder that pockets of liquidity and moments of clarity still exist — especially for those who understand the seasonal map.

Why Winter Rewards the Prepared

Every year the market tells the same story: liquidity fades before the holidays, and investors who respect that rhythm avoid most of the avoidable mistakes.

This winter just adds sharper edges.

Lower depth, higher uncertainty, and more sensitive flows mean the difference between opportunity and noise often comes down to discipline — knowing when to engage, and when to step back.

They’re simply easier to see when the tape gets thin and every move matters.

Written by Deniss Slinkins

Global Financial Journal