The Regulatory Green Light Changed Everything

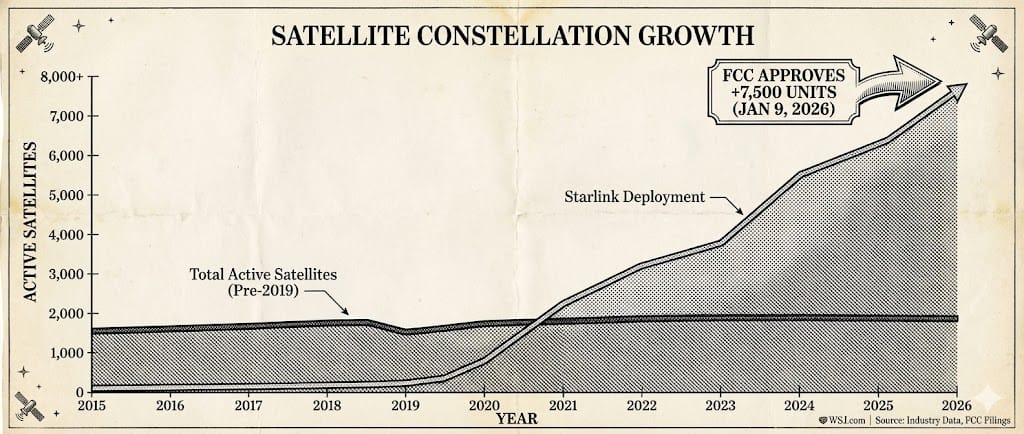

On January 9, U.S. regulators approved a major expansion: the Federal Communications Commission cleared SpaceX to deploy an additional 7,500 next-generation Starlink satellites.

That approval matters.

It unlocks:

a path toward a constellation approaching 15,000 satellites

broader spectrum access

expanded global coverage, including direct-to-device capabilities

This isn’t experimentation. It’s permission to scale.

Why Weekly Launches Matter More Than Headlines

Launching ~60 satellites a week signals industrial cadence, not hype.

It implies:

standardized manufacturing

predictable deployment timelines

long-term commercial intent

That’s how utilities are built — repetitively, quietly, and with regulatory backing.

By this stage, the question isn’t if the network works.

It’s how valuable the network becomes once it behaves like a carrier.

Private Capital Is Already Pricing the Outcome

Public markets haven’t had access yet.

Private markets have.

Large hedge funds have reported outsized gains in their private portfolios, driven in large part by exposure to SpaceX — with Starlink viewed as the primary value engine.

That’s a familiar pattern:

networks get repriced before they get tickers.

Why “Carrier Status” Changes Valuation

History is clear: the deepest value accrues to companies that own networks, not apps.

A global carrier:

controls distribution

sets pricing power

operates beyond borders and terrestrial constraints

Once communications becomes orbital, geography stops being a limiter.

That’s the shift investors are watching.

The IPO Optionality

2026 is increasingly viewed as a year when blockbuster IPOs re-enter the conversation.

If and when SpaceX goes public, the valuation discussion won’t be about rockets.

It will be about recurring revenue, global reach, and infrastructure-grade economics.

By then, most of the upside will already be priced.

The real asymmetry tends to exist before that window opens.

Final Thought

Most people will hear this story when it finally lists.

A smaller group understands it now — not as a space project, but as the next layer of global connectivity.

That difference in framing — and timing — is often where the returns come from.

How to Claim Your Stake in SpaceX with $500

from Brownstone Research

How did you find today’s briefing?

Written by Deniss Slinkins

Global Financial Journal