We are in the quiet stretch between Christmas and New Year’s. Markets slow down. Offices thin out. And many people finally look at their bank statements with fresh eyes.

This is usually when Americans start optimizing. Subscriptions get cancelled. Credit cards get rotated. Small percentages suddenly matter.

That instinct isn’t trivial. It’s adaptive. When purchasing power feels tighter, micro-optimization becomes a survival skill.

So let’s start with the easiest optimization available right now — because this window closes in a few days.

The Gap Between “Optimization” and Displacement

While households master the art of extracting value from rewards programs, a much larger shift is unfolding underneath the economy.

These two realities are connected. The reason Americans feel compelled to optimize is structural: Capital has been steadily separating from labor.

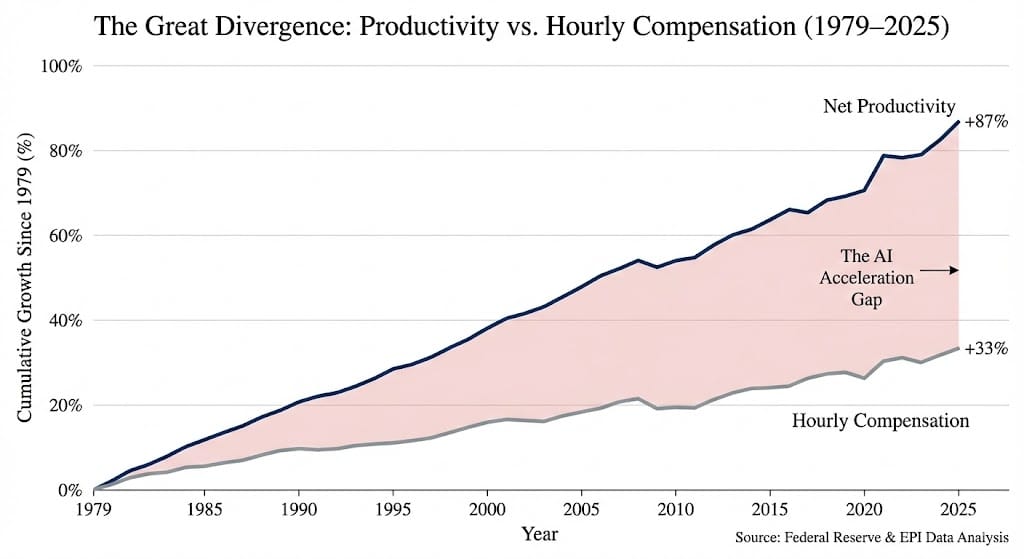

Since 1979, U.S. productivity has risen roughly 87%, while typical worker pay has increased about 33%.

This isn’t a moral failure or a policy accident. It’s a balance-sheet outcome. Efficiency gains from automation and AI increasingly accrue to shareholders. Workers capture the remainder — often in the form of incentives, rebates, and points.

Tier 1 vs. Tier 2

We are now operating inside a two-speed economy.

Tier One (Institutional): Where capital lives. Money moves instantly and compounds through automation.

Tier Two (Consumer): Where you live. Transfers wait for “business days.” Income grows slowly. Purchasing power is managed through friction reduction.

The dollar didn’t change its name. It changed who gets access to speed. And as this gap widens, we see Displacement. Tasks lose value quietly. Roles thin out. This is why corporations talk about automation and margins, while households talk about rewards, rebates, and budgeting apps.

It’s important to separate signal from volume.

Documentaries often compress decades of change into a sharp narrative. But in the real world, this shift is quiet.

What we are seeing is not a sudden break, but a gradual repricing.

As software "eats" more tasks, the premium for pure labor decreases. The value moves from doing the work to owning the workflow. This doesn't mean the end of work. It means the formula for financial stability is changing.

Old Model: Work harder = Earn more.

New Model: Optimize friction + Own assets = Maintain purchasing power.

Displacement is structural, not cinematic. And that makes it easier to manage if you stay rational.

The Practical Takeaway for 2026

There are two levels to respond on — and confusing them is where people get stuck.

At the Micro Level: Be efficient. Remove friction. Taking free incentives (like the Amazon bonus) is a rational adjustment to slower income growth.

At the Macro Level: Understand where structural earning power is moving. Long-term advantage increasingly comes from ownership, not just labor.

The Bottom Line

The most valuable assets of the next decade won’t be the loudest. They’ll be the systems nobody can afford to turn off.

And for households navigating the slower lane, efficiency isn’t optional.

Amazon Prime members: This card could be worth $100s every year

from FinanceBuzz

How did you find today’s briefing?

Written by Deniss Slinkins

Global Financial Journal