Meet the ChatGPT of Marketing – And It's Still Just $0.85 a Share

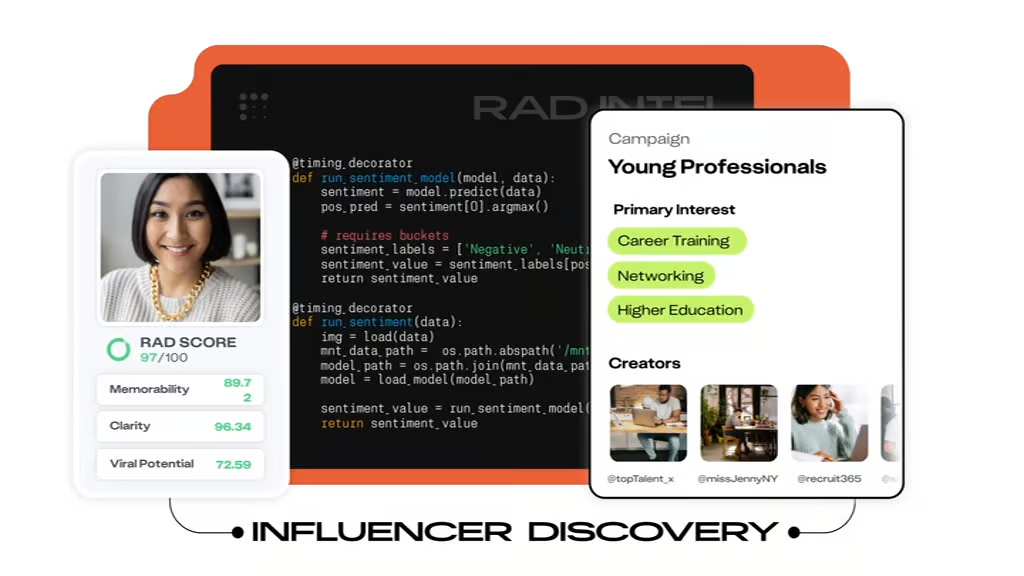

It’s easy to see why 10,000+ investors and global giants are in on the action. Their AI software helps major brands pinpoint their perfect audience and predict what content drives action.

The proof is recurring seven-figure contracts with Fortune 1000 brands.

Think Google/Facebook-style targeting, but smarter, faster, and built for the next era of AI. Major brands across entertainment, healthcare, and gaming are already using RAD Intel, and the company has backing from Adobe and insiders from Meta, Google, and Amazon.

Here’s the kicker: RAD Intel is still private—but you can invest right now at just $0.85 per share. They’ve already reserved their Nasdaq ticker, $RADI, and the valuation has soared 4900% in just 4 years*.

This is what getting “in” early feels like. Missed Nvidia? Missed Shopify? This is your second shot. Reg A+ (or Early) shares are still available—but not for long.

The Collapse of the Old Playbook

For more than a decade, digital advertising followed the same script: define an audience, choose a platform, load in targeting settings, and hope the algorithm behaved.

That world is disappearing.

Customer acquisition costs have exploded — rising more than 50% since 2022 for categories like Amazon sellers. CPMs climbed 10–15% last holiday season. iOS privacy changes slashed click-through rates by 37%, breaking the foundation of how brands used to target customers.

At the same time, the data that powered traditional targeting is evaporating. Safari and Firefox have blocked third-party cookies for years. Chrome is moving toward a user-choice model that experts say will lead 70–80% of users to shut tracking off completely.

Ad platforms didn’t adapt — they transformed.

The new reality is simple:

Old targeting models are too noisy, too expensive, and too unpredictable for the economics of 2025.

That’s why brands are searching for tools that can predict which content works — not guess.

|

The Shift to Predictive Engines

What’s replacing the old system isn’t more targeting.

It’s prediction.

Meta’s Advantage+ — now a $20+ billion business — doesn’t choose audiences the old way. It chooses outcomes. It takes thousands of creative variations and models which one will drive the next action. Result: 22% higher ROAS than manual campaigns.

Google’s Performance Max delivered 17–19% higher returns for retailers by doing the same thing: replacing targeting rules with machine-learning systems that decide, moment-by-moment, who should see what.

Amazon’s retail media unit crossed $54 billion, powered by closed-loop data and predictive models the open web simply can’t match.

This shift is why 84% of Fortune 500 companies are now integrating generative AI into marketing workflows. The goal isn’t automation — it’s clarity.

Brands want to know:

What will work before we spend the money?

Predictive attention engines deliver that answer.

Why This Is Becoming a Multi-Billion Pivot

The numbers tell the story:

Global ad spend will cross $1 trillion in 2026

71.6% of it will be algorithm-driven

Retail media alone will grow 14.1% next year

AI now powers 17.2% of marketing execution — double since 2022

Expected to reach 44% in three years

This isn’t incremental change.

It’s a rebuild of the entire ad economy.

Marketers once chased audiences.

Now they train algorithms.

And the companies providing predictive clarity — the ones helping brands understand which creative will resonate, and why — are landing the seven-figure contracts.

That’s the context where early-stage players like RAD Intel suddenly matter.

Not because they’re selling ads.

But because they’re building the infrastructure every brand now needs.

The Investors’ Angle

When industries rewrite their infrastructure, capital follows.

It happened with cloud computing.

It happened with streaming.

It happened with AI chips.

And now it’s happening again — but at the level of attention itself.

As brands shift from “targeting audiences” to “predicting behavior,” a new set of companies is moving into the center of the advertising economy. Some are the giants. But a few, still private, are shaping the edges of what comes next.

No predictions. No advice.

Just an observation:

When attention becomes measurable, the advantage belongs to whoever can predict action before anyone else.

Disclaimer: This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Please read the offering circular and related risks at invest.radintel.ai.

Written by Deniss Slinkins

Global Financial Journal