Why the “Rewards” Era of Consumer Finance Is Ending

If it feels like the friction in your daily financial life has increased — that “cash back” buys less, fees are stickier, and a small mistake now carries a real penalty — you’re not imagining it.

You’re witnessing the end of a specific economic cycle. One where consumer liquidity was quietly subsidized by cheap capital.

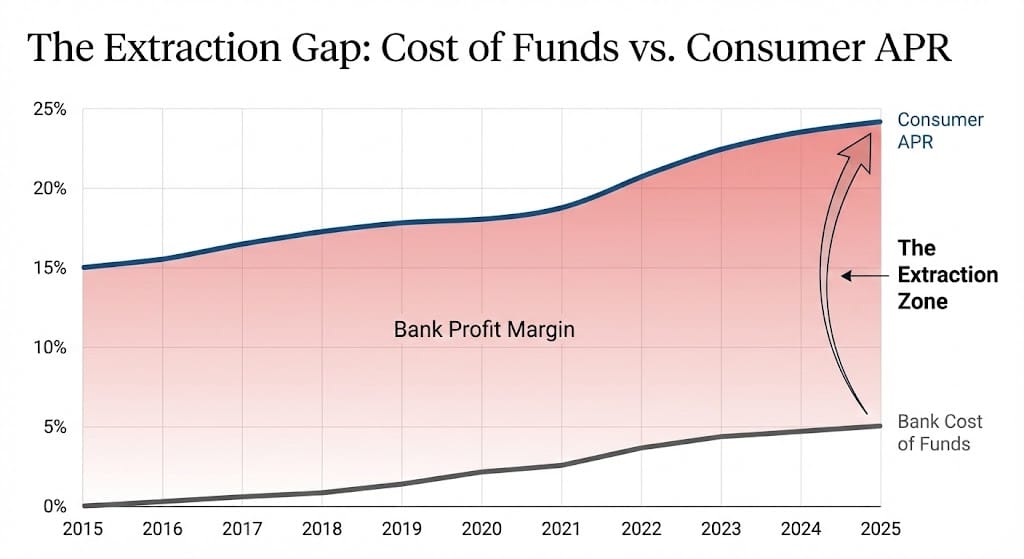

For more than a decade, American households were trained to treat their balance sheets like hedge funds. Leverage was cheap. Rewards were generous. Constant cash-flow optimization felt rational. But with average credit-card APRs near 24% and household debt above $18.6 trillion, the math has flipped.

What once felt like optimization now feels like extraction.

The Mechanics of Extraction

Under the hood of “free” money sits a simple engine: interchange fees. Every swipe transfers roughly 2–3% from merchants to banks. During the zero-rate era, that revenue funded generous rewards and aggressive customer acquisition. That era is over.

With funding costs near 5%, banks are tightening standards and quietly devaluing rewards. Points require more spending. Miles buy fewer seats. Cash-back caps shrink. The unspoken contract has changed: the friction remains, but the lubricant is gone.

In this environment, stopping 24% interest isn’t a clever hack.

It’s basic damage control.

The Liquidity Trap

This shift connects directly to the macro picture. The “quiet tax” of high interest rates is starting to bite. While headline debt-service ratios still look manageable, early-stage delinquencies are rising — a sign that the cash-flow game is breaking down at the margin.

When servicing everyday liquidity becomes expensive, behavior changes. Yield chasing fades. Solvency matters. Discipline becomes more valuable than income growth, because debt is no longer a lever — it’s an anchor. Most investors only notice this shift after it starts showing up in earnings.

This is typically the moment when attention quietly shifts from yield to preservation.

Editorial note: Gold has continued climbing well beyond the $3,600 level referenced below — trading above $4,530 per ounce as of today. That breakout marked the inflection point. What matters now is what followed.

A Whiff of the 1970s

There’s a faint but familiar rhyme with the late 1960s and early 1970s. That period also began with prosperity masking deeper monetary strain. When confidence cracked, the shift wasn’t just about inflation — it was about preservation.

Back then, households moved from optimizing flows to protecting stock. Cash lost appeal. Hard assets gained relevance. The “points game” we’ve played for years was a symptom of confidence in fiat systems. As that confidence erodes through devaluation and dilution, rational actors stop gaming rewards and start thinking about resilience.

The First Layer Isn’t Enough

For the last 15 years, smart household finance meant optimizing flow: the right card, the right refinance, the right spread. That era is ending.

Cash-flow discipline is now the first line of defense — nobody should accept 24% interest by default. But it’s only the first layer. The deeper question is capital allocation. In a world of sticky inflation and real funding costs, the friction you feel at checkout is a warning:

The system no longer pays you to participate.

It charges you.

Adjust your balance sheet accordingly. Sometimes the smartest move is simply to stop the bleeding.

Take a Break from High Interest

from Finance Buzz

How did you find today’s briefing?

Written by Deniss Slinkins

Global Financial Journal