Everyone is looking at the engine. Almost nobody is checking the fuel lines.

While retail investors continue to chase Nvidia’s stock price, smart capital has quietly rotated. Why? Because on January 6th, the entire AI narrative shifts from "Who makes the fastest chip?" to "Who can keep these chips from melting down?" Jensen Huang knows it. And he’s bringing 7 specific partners along for the ride.

The Shift Investors Are Missing

For most of the past two years, the AI story was simple: more compute, faster chips, larger models.

Markets rewarded anyone with exposure to silicon.

But by the end of 2025, that narrative quietly broke.

Even NVIDIA — the company that defined the AI boom — has begun signaling that performance gains are no longer limited by chip design alone.

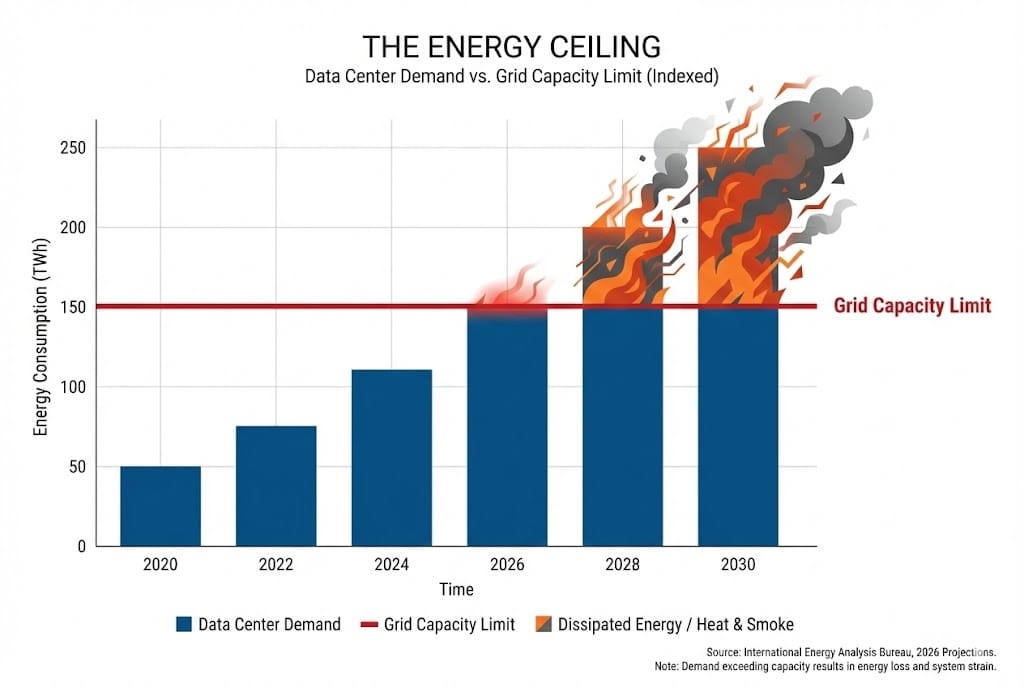

The bottlenecks now sit outside the data center racks: power delivery, system integration, and physical infrastructure that can scale alongside demand.

This is not a slowdown. It’s a transition.

From Compute to Capacity

Recent disclosures and industry briefings suggest that the next phase of AI investment will be driven less by raw processing power and more by who can reliably support it.

That includes:

Power management systems

Advanced cooling solutions

Grid-scale infrastructure

Specialized partners embedded deep inside NVIDIA’s ecosystem

These aren’t consumer-facing names. They don’t dominate headlines.

But they sit directly on the critical path of AI deployment.

And historically, these are the companies that reprice first — quietly — before the broader market catches on.

Why This Moment Matters

The timing is not accidental. As we enter 2026:

AI capex remains elevated.

Hyperscalers are locking in long-term buildout plans.

Tolerance for operational bottlenecks is approaching zero.

That combination forces capital to move downstream — away from the obvious winners and toward the enablers that keep the entire system running.

This is where early positioning matters most. Not when the story becomes consensus — but when leadership signals the shift before Wall Street fully adjusts its models.

Final Thought

The most important AI moves in 2026 won’t come from louder hype.

They’ll come from structural decisions — about power, reliability, and scale — that determine who can actually deliver.

Jensen Huang just pulled back the curtain on that reality.

The investors who pay attention early are rarely the ones chasing headlines later.

Jensen Huang’s Shocking Announcement

from Brownstone Research

How did you find today’s briefing?

Written by Deniss Slinkins

Global Financial Journal