Merry Christmas Morning.

Markets are closed. The trading algorithms are quiet. But the "utility layer" of the global economy doesn't get a holiday.

Right now, 300 miles above your roof, a massive web of laser-linked satellites is flying at 17,000 mph. They are routing defense data and powering the signals for millions of new devices being unboxed this morning.

It is the only infrastructure that never sleeps. And according to one legendary investor, it is about to create a new class of millionaires.

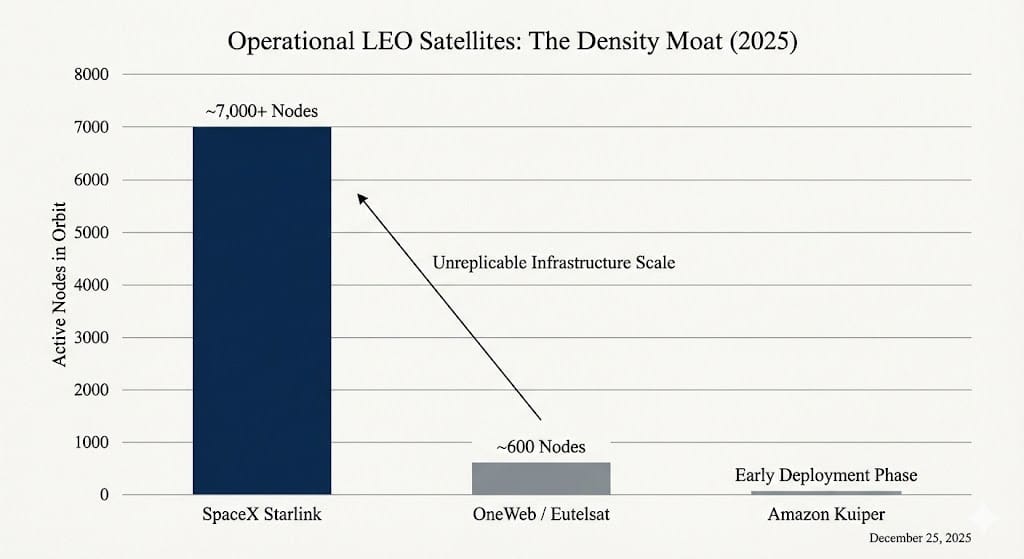

Density is the Asset

The most important metric here isn’t “download speed.” It’s density.

Legacy satellite internet sat 22,000 miles away in geostationary orbit, which meant brutal latency. A dense LEO constellation changes the physics. With thousands of satellites in low orbit, latency can approach terrestrial broadband in many use cases—not because one satellite is magical, but because there are enough nodes overhead that the network can route around gaps and congestion. At this scale, coverage stops being about access and starts being about reliability under stress.

That density also creates resilience. If one satellite fails, the signal hops. If a region is disrupted, traffic can reroute. For national security customers, redundancy isn’t a bonus feature—it’s the product.

This is one reason the U.S. government has been willing to sign meaningful contracts for Starlink’s defense-oriented services (often discussed under the “Starshield” umbrella), with reported contract ceilings reaching into the low tens of billions. You don’t commit that kind of money for a “nice-to-have.”

The Bypass Mechanism

Most casual observers still value Starlink like a rural ISP.

That misses the point.

Yes, consumer adoption has become large—Starlink has been discussed in the context of roughly 9 million subscribers and revenue that could approach ~$12B annually on some projections. But the consumer business is also a bootstrap: it helps finance and validate a capability with much broader implications.

Starlink isn’t merely competing with telecom providers. It’s bypassing them.

Traditional data paths depend on a chain: local ISPs → national backbones → undersea cables → jurisdictional bottlenecks. A space-based network with inter-satellite links can route signals along paths that are less dependent on any single country’s terrestrial choke points. That matters for shipping fleets, airlines, offshore energy platforms, remote mining operations, and any enterprise whose “office” moves.

A ship in the Pacific doesn’t care whose tower it can see. It cares whether the connection is stable and the latency is usable.

Once a connectivity layer becomes geography-agnostic, it starts to resemble something closer to a payment rail than a consumer gadget.

Infrastructure Economics, Not App Economics

This is where the market often gets the classification wrong.

Tech companies are valued on attention, content, and churn. Infrastructure is valued on barriers, reliability, and compounding utility.

Starlink’s moat is physical. You can’t “code” your way into low-Earth orbit. You have to launch mass—repeatedly—at scale, with manufacturing discipline, ground stations, spectrum coordination, and operating cadence. Competitors can spend money, but they can’t compress time.

That’s why comparisons to earlier buildouts are useful. Undersea cables, railroads, power grids: at first they look like expensive projects. Then they become competitive advantages. Eventually they become invisible because everyone relies on them.

The most valuable layer isn’t the one with the loudest marketing. It’s the one people can’t afford to turn off.

What to Watch in 2026

Two questions matter more than subscriber headlines:

Who becomes “anchor customers” for the always-on layer?

Defense is obvious. So is logistics. The next wave is enterprise connectivity that replaces multiple terrestrial contracts with one resilient network.How does the market price a global carrier that isn’t bound to geography?

A traditional telecom is constrained by regulation, rights-of-way, and local buildouts. A LEO carrier scales differently. The underlying economics are still capital-heavy—but capital-heavy is exactly what creates durability.

None of this requires you to believe in sci-fi. It requires you to notice what is already happening: the “space story” is becoming a plumbing story. And plumbing is where the long compounding often hides.

How to Claim Your Stake in SpaceX with $500

from Brownstone Research

How did you find today’s briefing?

Written by Deniss Slinkins

Global Financial Journal