Why Buffett Is Waiting — and Why Gold Isn’t

Buffett’s cash pile isn’t a bet against markets. It’s a bet on timing.

Across Wall Street, analysts increasingly read the hoard as a warning: broad equities offer limited upside in 2026 relative to risk, while optionality is being preserved for a better entry .

Gold operates outside that trade-off.

It doesn’t require earnings growth assumptions.

It doesn’t depend on policy promises.

And it historically benefits when fiscal discipline weakens.

The Price Action Is Structural, Not Speculative

In early January, gold held near record highs, supported by a weaker dollar and persistent macro uncertainty. Several banks now project higher targets into late 2026, citing sustained central-bank demand and hedging behavior — not retail speculation.

That demand matters. Governments are buying gold, consistently and across regions. This is reserve behavior, not a trade.

Why Miners Change the Equation This Cycle

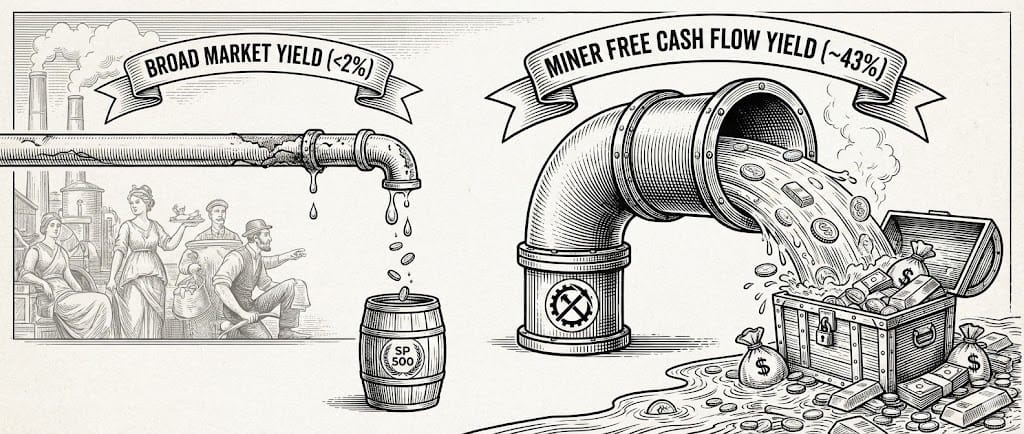

Higher gold prices expand miners’ free cash flow immediately. Unlike prior cycles, leading operators are returning capital and trading at discounts despite stronger margins.

Corporate activity reflects that reality. Major producers have begun strategic evaluations of core assets in response to the price environment — a sign the sector is moving from price-taker to capital allocator .

Cash flow — not narratives — is doing the work.

Final Thought

Bitcoin may continue to perform — or be overtaken by the next technological shift.

Gold doesn’t need to win arguments.

It needs to do what it has done for 6,000 years: protect purchasing power when systems are stressed.

That’s why Buffett’s next move likely won’t look exciting at first.

And why it may matter more than most investors expect.

Buffett’s Next Big Gold Bet Could Be Her

from Golden Portfolio

How did you find today’s briefing?

Written by Deniss Slinkins

Global Financial Journal