AI was supposed to scale like software.

Instead, it is colliding with the slowest systems in the economy: power grids, land, permits, and time.

That collision is forcing capital to move — often far from the places investors were trained to look.

To see exactly what this looks like on the ground, look at what’s happening in Kemmerer, Wyoming right now...

When Innovation Hits Infrastructure

Artificial intelligence is often framed as a software race. In reality, it has become an infrastructure race.

Modern AI data centers require 80–150 kilowatts per rack, several times more than traditional facilities. At that scale, the constraint is no longer computing power — it is whether electrons, cooling water, and permits can arrive on time.

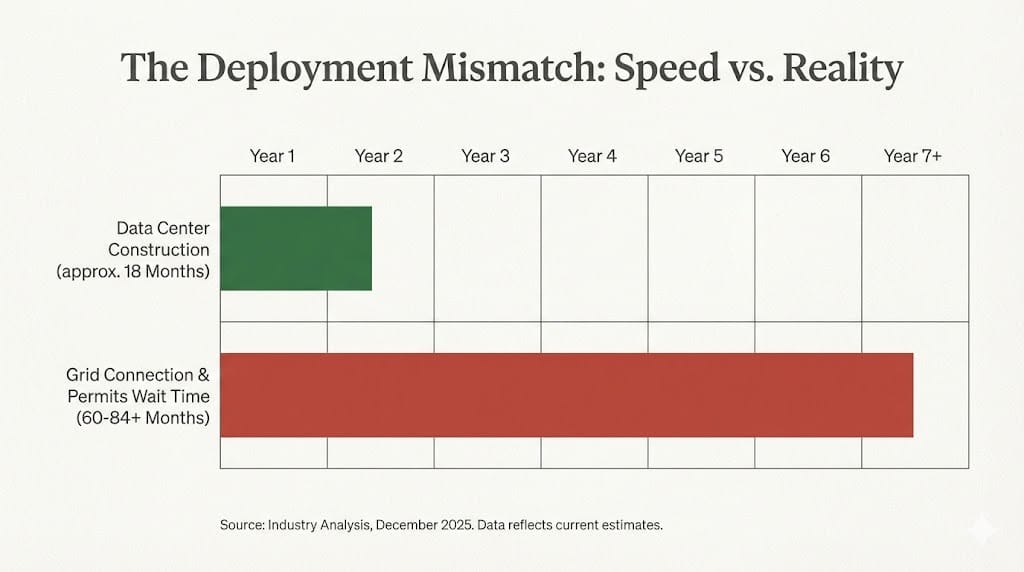

The U.S. Department of Energy projects data centers could consume up to 12% of national electricity by 2028, nearly triple their share just a few years ago. Yet transmission upgrades routinely take five to seven years, and transformer delivery timelines have stretched into multiple years.

In Northern Virginia, the world’s largest data-center corridor, new grid connections face delays exceeding five years. Similar bottlenecks have emerged in London, Singapore, and other mature hubs. Capital that assumed infinite scalability is discovering that physical systems do not move at software speed.

Why Capital Is Looking Backward to Move Forward

Faced with these delays, developers have adjusted their calculus. Instead of chasing proximity to talent or fiber density, they are prioritizing what already exists:

substations with available headroom

industrial zoning in place

water rights approved years ago

communities accustomed to large-scale energy projects

This explains why billions in new investment are landing in secondary markets and small towns. Locations with legacy infrastructure can compress development timelines by three to five years — an advantage that matters far more in a higher-rate environment.

A project that breaks ground in 18 months rather than six years generates earlier cash flows, lower financing risk, and greater certainty. In today’s market, speed and permission are worth more than optionality.

The Market’s Blind Spot

Public markets still price many assets as if location and time are interchangeable. They are not.

Land in saturated hubs continues to trade at premium valuations despite multi-year grid delays. Meanwhile, industrial sites with intact transmission access and existing permits are often valued like obsolete real estate.

This mismatch reflects an outdated mental model. Capital markets became accustomed to frictionless expansion. The next phase will reward those who understand where capacity already lives, not where innovation headlines point.

A Geographic Reordering

None of this represents a retreat from technology. The AI build-out will continue. But it will not unfold where investors expected — or on the timelines they modeled.

Energy, land, permits, and geography have reasserted themselves as decisive factors. Capital is adjusting accordingly, flowing toward places that look unremarkable on a map but irreplaceable on a construction schedule.

The next phase of American investment will not be defined by novelty.

It will be defined by who can build first.

WARNING: Footage From Wyoming Stunned Everyone

from Brownstone Research

How did you find today’s briefing?

Written by Deniss Slinkins

Global Financial Journal