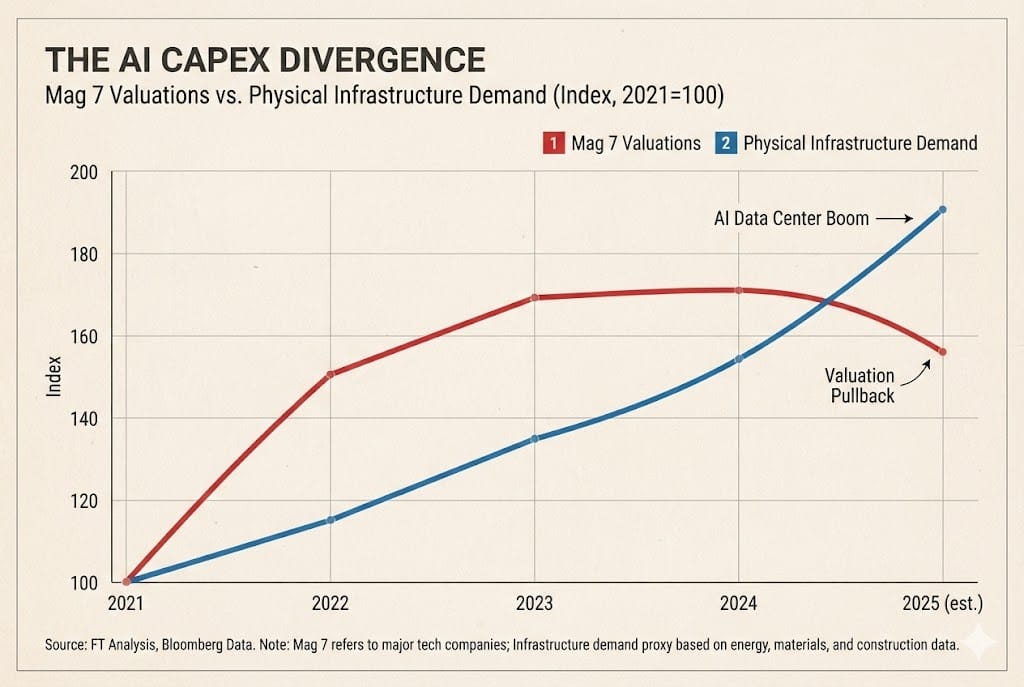

The trade that defined the equity markets from 2023 through mid-2024 has hit a mathematical wall.

For eighteen months, capital concentration in the "Magnificent Seven" reached historic extremes. However, data from late 2024 and Q1 2025 confirms that we have entered a phase of structural deceleration. This is not a sentiment shift; it is a rotation driven by valuation ceilings and the law of large numbers.

Institutional capital is now systematically rotating "down the stack"—moving out of overextended consumer-facing tech and into the physical infrastructure required to keep the AI economy running.

The Valuation Ceiling

The "infinite growth" narrative for the largest caps is colliding with reality. Our analysis of recent fundamentals shows distinct cracks in the armor of the leaders:

Amazon (Retail Deceleration): While AWS remains robust, the core retail engine has become a drag on valuation. U.S. e-commerce growth is forecasted at just 6% for 2025. Operating margins have faced pressure, dropping from 11% to 9.7% in recent quarters. The market is increasingly unwilling to pay a tech multiple for a single-digit growth logistics business.

Tesla (Margin Compression): Tesla’s transition from a hyper-growth auto stock to an "AI robotics play" is a defense mechanism against deteriorating fundamentals. Operating margins have compressed from 9.2% in 2023 to 7.2% in 2024. The stock is no longer trading on auto sales, but entirely on the speculative execution of humanoid robotics—a sector where industrial reality lags far behind the hype.

This data is not secret, but the mainstream financial media is only just now acknowledging it. When Bloomberg begins echoing these sentiments, it confirms that the narrative has shifted.

As software valuations stall, capital is flowing into the physical infrastructure required to build out the grid.

The "Capex Wall"

The rotation is further accelerated by what analysts call the "Capex Wall."

Despite a market cap touching trillions, companies like Nvidia face a unique challenge. With 90% of revenue tied to data centers, the company requires global capital expenditure to double continuously to sustain its multiple.

While cloud GPUs remain "sold out," the monetization of these chips by end-users (software companies) lags behind the infrastructure spend. Institutional managers are recognizing this "air pocket" and are taking profits to reallocate into sectors with more tangible growth runways.

The New Opportunity: "Physical AI"

If capital is leaving the "Generals" (Amazon, Tesla, Nvidia), where is it going?

It is moving into Physical AI. As the GPU shortage eases, the bottleneck has shifted to the physical infrastructure required to plug them in. 13F filings show hedge funds rotating into industrial automation and data center hardware.

1. Liquid Cooling This is the critical choke point for next-gen AI clusters. The market for data center liquid cooling is projected to grow from $4.18 billion to over $5 billion in 2025. By next year, 35% of all AI-centric data centers are expected to mandate liquid cooling solutions to manage thermal density.

2. Optical Interconnects Copper cabling has hit a physical limit for data transmission. The market for optical interconnects (to link GPU clusters) is valued at $18.6 billion in 2025, growing at a ~15% CAGR. This is the "boring" hardware that makes the "exciting" software possible.

Robotics: Hype vs. Reality

Finally, the rotation is evident in robotics. While consumer headlines focus on Tesla’s Optimus humanoid robot (pilot production only), smart money is chasing industrial automation.

Deal value in industrial robotics surged to $7.3 billion in H1 2025. Why? Because while humanoids are speculative, industrial robots are seeing steady, predictable unit growth of 5%. The companies supplying these machines are cash-flow positive today, contrasting sharply with the "diet of wild promises" supporting Tesla's valuation.

The "Sell" calls discussed in today’s lead story are not about betting against technology; they are about betting on the infrastructure that supports it.

Are you still holding the "Mag 7"?

Written by Deniss Slinkins

Global Financial Journal