Merry Christmas Eve. The day the financial system moves even slower than usual.

If you reviewed your household spending this month, you likely noticed the friction. A pending charge that held your balance hostage over the weekend. A transfer waiting for "business days" to clear.

For the American consumer, the dollar remains what it has been for decades: a store of value that moves at the speed of a legacy database—reliable, but sluggish.

We tend to accept this latency as the cost of doing business. But there is a way to optimize it immediately.

Settlement at Two Speeds

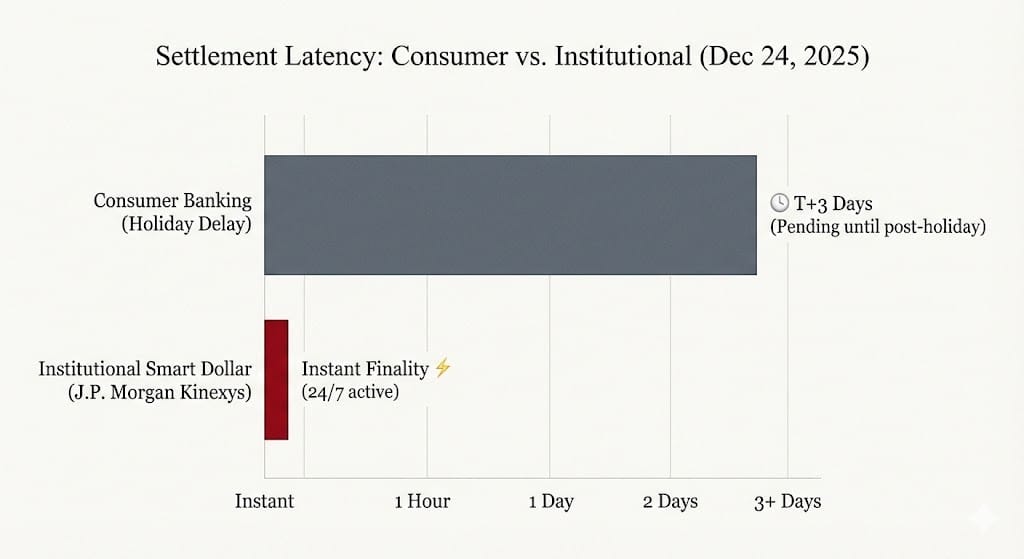

While households navigate payment delays and bank holidays, the structural reality of the U.S. dollar has quietly bifurcated.

We are now living in a two-speed monetary system. There is the Consumer Dollar—visible, nominal, and slow. And there is the Institutional Dollar, which is currently being re-engineered into a high-velocity settlement instrument.

The Plumbing, Not the Price

To understand this shift, look away from the Consumer Price Index and toward the back-office plumbing of Wall Street.

Consider J.P. Morgan’s Kinexys. As of this month, the platform is processing daily transaction volumes exceeding $2 billion. These aren't standard wire transfers; they are programmable, intraday settlements that allow liquidity to move 24/7/365. This is still a small slice of JPMorgan’s total flows — but the point isn’t volume. It’s architecture.

While your bank transfer sleeps for the holidays, the institutional layer is awake.

The New Collateral Hierarchy

Why does this matter? Because in a high-rate environment, idle money is expensive.

When a bank or asset manager has to wait 24 hours for a Treasury trade to settle, that capital sits dead, earning nothing. The institutional layer is solving this by turning the dollar and its equivalents (Treasuries) into assets that settle atomically—instantly and final.

We are seeing the issuance of tokenized U.S. Treasuries surpass $7.4 billion this month, driven not by retail traders but by institutions needing "always-on" collateral.

Speed is the New Yield

This creates a distinct tiered system:

Tier 1: Institutional dollars that move instantly, optimizing yield every second.

Tier 2: Consumer dollars that sit in non-interest-bearing checking accounts, waiting for "business days" to clear.

The lesson here is not to rush into speculative digital assets. It is to recognize that "money" is being repriced based on its velocity. The "institutional dollar" is now a software-native asset. Understanding this two-speed system is the first step in recognizing where value will accrue in the coming decade.

How did you find today’s briefing?

Written by Deniss Slinkins

Global Financial Journal