The geography of America’s compute footprint is spreading outward. Northern Virginia’s “Data Center Alley” can no longer absorb the next wave of demand. So the map is shifting — west, south, and into places that until recently had nothing to do with digital infrastructure.

Tennessee is now one of the most surprising pivots. In November, the Department of Energy opened part of the Oak Ridge Reservation to private development. That move signals something new: federal land is being unlocked specifically for gigawatt-scale AI facilities, the kind that require more power than some cities.

Ohio and Texas are now the two heaviest magnets for AI capital.

Amazon’s $7.8 billion expansion in Ohio is underway, and the OpenAI–Oracle “Stargate” cluster is tracking toward a scale that exceeds anything built before.

In Texas, the activity has become nonstop. Meta confirmed a $1.5 billion facility in El Paso, and Vantage Data Centers broke ground on a 1.4-gigawatt campus in Shackelford County — a site designed to draw enough electricity to rival industrial manufacturing complexes.

What These New Sites Actually Require

A few years ago, a typical hyperscale rack pulled 10 kilowatts.

Now, the racks designed for NVIDIA’s Blackwell and Rubin architectures exceed 100 kilowatts per rack. That single fact explains why the entire economics of AI infrastructure have changed. By late 2025, liquid cooling had become the dominant standard. According to sector data, 84% of all cooling-tech funding deals this year were liquid-based systems, marking the end of the air-cooling era.

Heat is only half the story.

The bottleneck is increasingly light, not electricity.

Copper connections can’t move data fast enough as clusters grow to tens of thousands of chips. That’s why the market for optical transceivers and indium-phosphide lasers is in shortage — demand is running roughly 2× above supply, and every megacluster now requires massive investments in photonics.

The Strain Underneath

There’s now a structural mismatch between how fast tech firms can build a data center and how slowly utilities can upgrade the grid.

A modern AI campus: ~18 months

High-voltage transmission upgrades: 3–6 years

That gap is showing up in real prices.

In Pennsylvania, electricity rates are up roughly 15% year-over-year — double the national pace — driven by capacity auctions strained by new data-center demand. PJM Interconnection added $9.3 billion in capacity costs for 2025–2026 alone.

Political patience for this load is thinning.

In rural Pennsylvania and Virginia, local residents are pushing back. For them, the promise of “the AI economy” looks less appealing when the utility bill jumps before the jobs arrive. At the federal level, policymakers are attempting to keep up — including the new “Liquid Cooling for AI Act” — but the scale of demand is outrunning legislative timelines.

What 2026 Likely Brings

2026 won’t be defined by model announcements.

It will be defined by trenching fiber, expanding substations, and securing enough high-bandwidth memory to feed clusters that are already sold out through the end of next year.

Taiwanese exports to the U.S. surged 63% in the first ten months of 2025 — almost entirely due to AI hardware. That’s now a strategic dependency: a disruption in the Pacific supply chain doesn’t just hit tech companies; it can stall billion-dollar construction sites in Ohio overnight.

AI has become physical.

It is land, water, transformers, and cooling loops.

It looks less like “the cloud” and more like a new chapter of American industrial policy — one built not on rhetoric, but on concrete and copper.

Final View

The momentum behind AI is no longer abstract.

The U.S. is building an industrial base around computation itself — and doing so at a pace that rivals past national infrastructure projects.

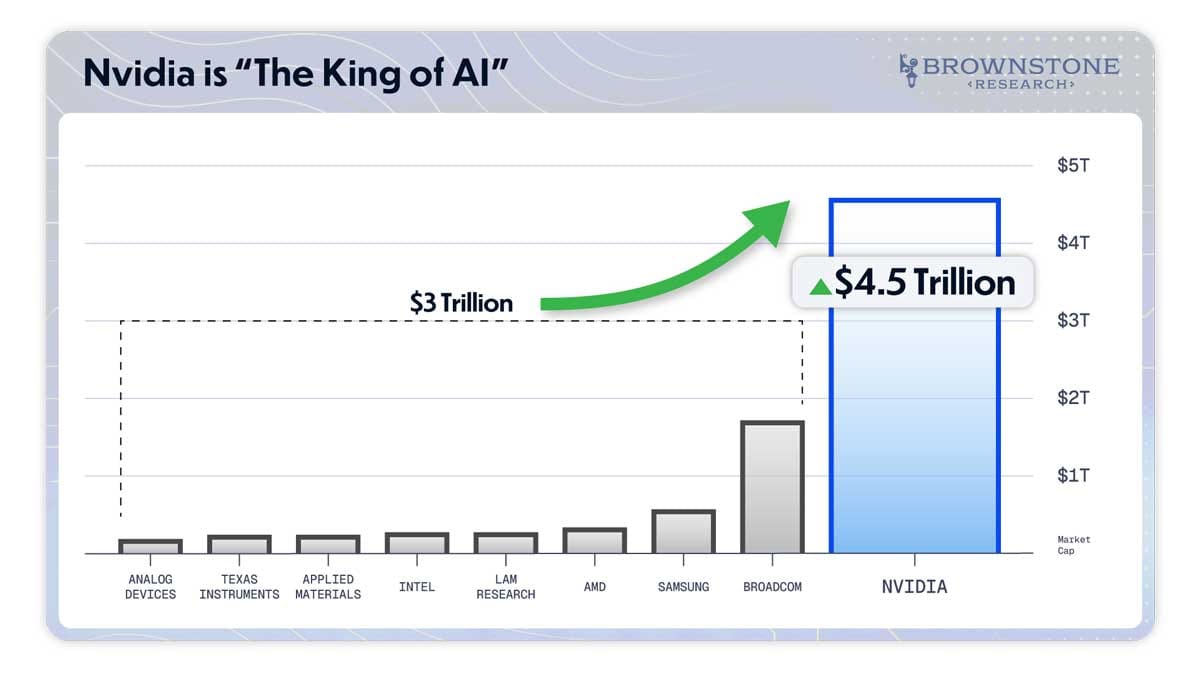

For investors, the headline may still be about chips.

But the story — the real story — is shifting to the systems that power, cool, and connect the chips.

Those are the pieces that tend to move first when the next cycle begins.

Written by Deniss Slinkins

Global Financial Journal