When the Grid Becomes the Bottleneck

For most of the past decade, artificial intelligence scaled like software. More chips. More data. More models. Power was assumed.

In 2025, that assumption broke.

Across the U.S. and Europe, data-center operators are discovering that electricity — not compute — is now the binding constraint. Grid connections are delayed by years. Utilities are rationing capacity.

This is not a temporary mismatch. It’s structural. Reuters reports that Big Tech has shifted to an “all-of-the-above” energy strategy — renewables, gas, and nuclear — not for optics, but because 24/7 baseload power has become non-negotiable.

AI does not pause when the sun sets.

Why Google Looked to Space

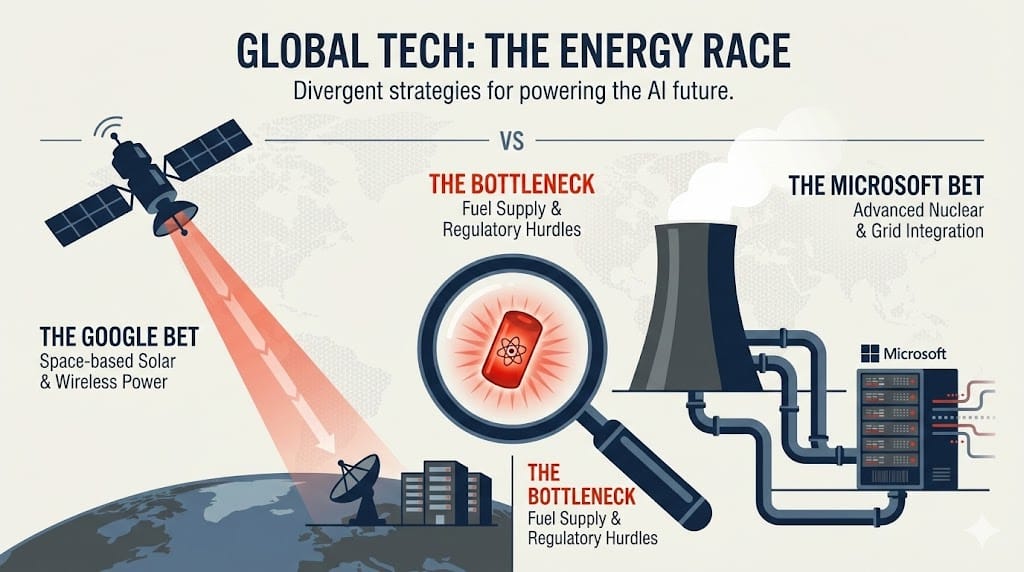

Against that backdrop, Google’s Project Suncatcher makes sense. The initiative explores space-based solar power as a way to bypass terrestrial limits: no land constraints, no grid bottlenecks. From an engineering standpoint, it’s elegant.

From a strategic standpoint, it’s revealing.

When one of the world’s most sophisticated infrastructure builders starts publishing research on orbital power for AI, it’s an implicit admission: the existing grid cannot scale fast enough.

Microsoft Chose a Different Path

While Google experiments, Microsoft acted.

Instead of waiting for grid upgrades, the company backed the restart of Three Mile Island Unit 1 — a nuclear facility capable of delivering reliable baseload power directly to AI data centers.

The message was clear: If the grid can’t deliver, power must be brought to the data.

The Quiet Nuclear Revival

This shift is happening faster than markets appreciate. Financial Times reporting shows data-center operators deploying on-site gas turbines simply to stay operational. But governments are moving toward a more permanent solution.

In the U.S., new executive directives prioritize nuclear development as a strategic asset. The result is a narrow funnel: Only energy sources that can deliver continuous, high-density power survive.

Where the Constraint Tightens

What’s underpriced in this conversation isn’t nuclear reactors themselves. It’s what they require.

Advanced reactors — particularly the SMRs being fast-tracked for AI workloads — depend on specialized nuclear fuel (HALEU) that is not widely produced.

Supply chains are thin. Domestic capacity is limited. And geopolitics matter.

As export controls tighten and global energy security becomes strategic, inputs once considered niche move to the center of industrial planning.

Markets are still valuing AI as a software story. The infrastructure reality tells a different story.

The Capital Implication

When constraints shift, capital follows quietly. This is not a consumer narrative. It’s an infrastructure one. And infrastructure re-pricing never happens all at once.

It starts with long-term contracts.

Then regulatory alignment.

Then supply bottlenecks.

By the time the shortage becomes obvious in earnings calls, positioning is already crowded.

Final Thought

The AI race is no longer about models or chips alone. It’s about who controls the energy that makes them run.

Google looked to orbit. Microsoft went nuclear.

And beneath all of it sits a narrow set of physical inputs that cannot be scaled overnight. One small company currently holds the key to the domestic HALEU supply chain.

Google’s Space Gamble Just Crowned an “AI Fuel” Monopoly

from Brownstone Research

How did you find today’s briefing?

Written by Deniss Slinkins

Global Financial Journal