Why This Week Changed the Conversation

This wasn’t a single headline. It was alignment.

The largest U.S. grid operator, PJM Interconnection, unveiled emergency measures to manage AI-driven power demand, acknowledging that current infrastructure cannot absorb projected loads.

Google publicly stated that transmission delays of 10–12 years are now the primary bottleneck for connecting new data centers.

Washington signaled a policy pivot: proposals now push tech companies to fund new power generation directly, rather than relying on public grids.

Markets didn’t panic. Volatility stayed contained. That’s the tell.

This wasn’t fear-driven behavior. It was pre-emptive positioning.

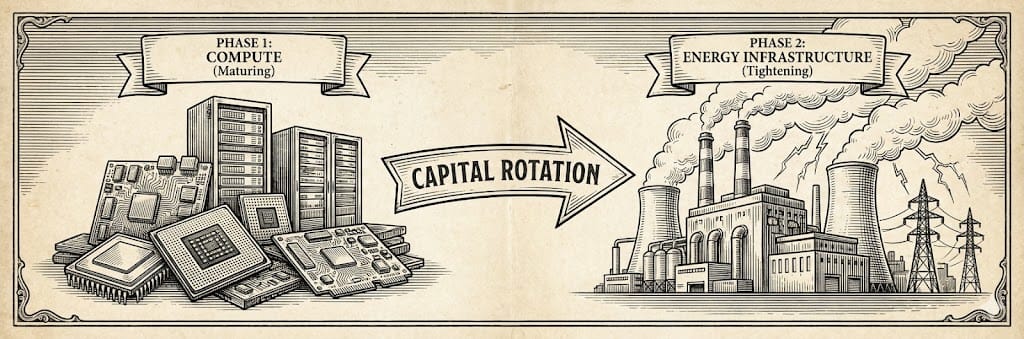

From Compute Scarcity to Power Scarcity

The first AI wave rewarded chips and accelerators.

That layer is maturing. Supply is scaling. Margins are compressing. Capital intensity is rising.

What’s tightening now is the layer beneath everything: reliable, always-on power.

AI doesn’t idle. Training and inference run 24/7. Intermittency isn’t acceptable. Latency isn’t optional.

When compute becomes abundant but energy does not, capital rotates — not into headlines, but into infrastructure that controls supply. That’s where pricing power accumulates.

Why Washington Is Moving Faster Than Markets

Industrial policy doesn’t wait for consensus.

Recent proposals would require large data-center operators to finance their own generation, reshaping how AI capacity gets built in the U.S. The logic is simple: if AI drives demand, AI must help build supply.

This reframes energy assets as strategic infrastructure, not utilities. Permitting, capital access, and fast-tracking are already shifting to favor scale, durability, and domestic production.

That’s the context behind Freedom Factories.

The Window Most Investors Miss

Public markets usually price outcomes after infrastructure is visible.

The asymmetry appears earlier — when constraints are acknowledged, but solutions aren’t yet widely owned.

Google talking about space is a tell.

It means terrestrial options are already binding. When the problem is power, the winners aren’t the loudest companies — they’re the ones positioned to supply fuel at scale.

Final Thought

Every technology boom eventually collides with physics. AI has reached that point.

When the conversation shifts from models to megawatts — and from servers to fuel — the opportunity set changes with it.

Those shifts tend to reward investors who recognize constraints early, not those who chase narratives late.

How did you find today’s briefing?

Written by Deniss Slinkins

Global Financial Journal