Wall Street is betting on a miracle.

They believe AI will scale seamlessly from code into the physical world. They are pricing in a future where robots scale like software.

But the industrial data just signaled a hard stop.

While the broad market ignores the warning signs, a quiet revolution is actually happening—just not where most investors expect.

It’s happening right here:

The Physical Reality of AI

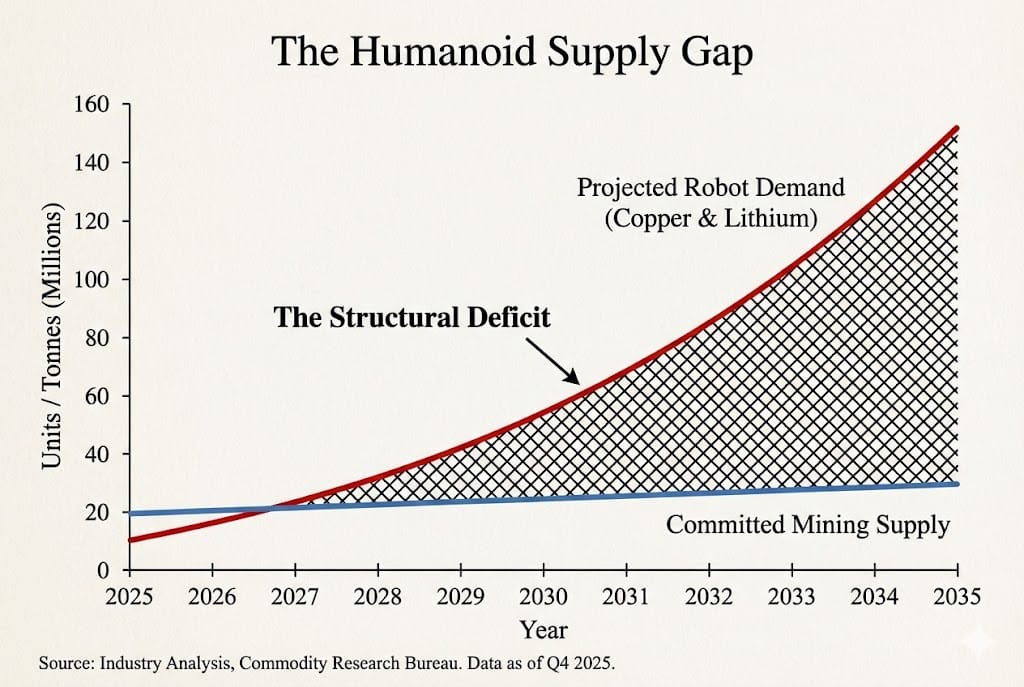

The fundamental misconception driving today's market is that embodied AI scales like code. It does not. It scales like civil engineering.

The numbers for 2025 are sobering:

EV Contraction: U.S. sales are projected to fall 2.1% this year, with Q4 volumes dropping 46% after tax credits expired.

The "Automation Gap": Despite the hype, only 29% of warehouses worldwide have implemented any form of automation.

The autonomous robots market faces substantial upfront costs and integration complexities that can increase deployment time by 40%. Capital that assumed "infinite scalability" is discovering that physical systems require land, power, and years of permits.

China as the Silent Variable

While American markets bid up narratives, China is building the physical substrate.

This is the most underpriced variable in Western capital markets today:

Dominance: China accounted for 54% of all new industrial robot installations worldwide in 2024.

Independence: Their manufacturing upgrade plan explicitly targets 70% domestic content of core materials by the end of 2025.

Geopolitical tension is becoming a binding constraint. With U.S. export controls now restricting semiconductor equipment, China is accelerating domestic substitution—achieving 80-90% self-sufficiency in mid-tier robot components.

The market assumes technology flows freely. It does not. The decoupling between narrative and reality is no longer a glitch—it is the defining story of 2025.

How did you find today’s briefing?

Written by Deniss Slinkins

Global Financial Journal