Why This Week Matters More Than Headlines

This week delivered a rare alignment of signals.

Gold and silver pushed to fresh record levels, not on retail frenzy, but on policy and positioning. At the same time, global central banks publicly emphasized the importance of monetary independence — a message that only surfaces when the plumbing of the system is under strain.

Equities didn’t panic. Volatility stayed contained. That’s precisely the point. This wasn’t fear-driven behavior. It was pre-emptive allocation.

When Interest Becomes the Constraint

At modest levels, debt is a policy choice.

At extreme levels, interest becomes the policy.

By 2026, net interest expense is on track to rival the largest federal outlays. That reality compresses timelines and narrows options. It also changes how capital evaluates risk. In those environments, assets tied to physical production, cash flow, and domestic policy support behave differently than financial abstractions.

That distinction is becoming harder to ignore.

Why Mining Re-Enters the Strategic Conversation

Mining isn’t being reframed as a trade. It’s being reframed as infrastructure.

Permitting, capital access, and regulatory posture are shifting in ways that favor scale, discipline, and existing assets — not speculative exploration. That matters because large-cap miners don’t need exponential price moves to generate value. They need stability, access, and time.

Those conditions are quietly forming now.

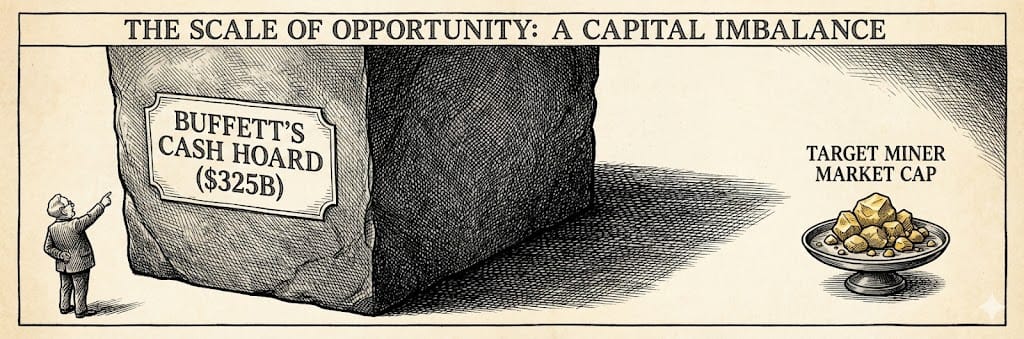

Why Buffett Waits — and Why That Matters

Buffett doesn’t chase price. He waits for:

policy clarity

durable free cash flow

and mispricing that survives cycles

When those elements align, his moves tend to mark inflection points, not headlines. With equities fully valued, fiscal pressure rising, and real assets re-entering institutional frameworks, the setup looks increasingly familiar.

Final Thought

The most important shifts rarely arrive with alarms.

They arrive through policy decisions few read, capital movements few notice, and positioning that’s already underway before narratives catch up.

When real assets move quietly — and capital waits patiently — the opportunity is usually earlier than it feels.

How did you find today’s briefing?

Written by Deniss Slinkins

Global Financial Journal